Many economists insist that free trade benefits everyone. The argument goes like this:

Model 1

Let’s say there are two countries, Country 1 and Country 2, each with a bread factory and two citizens who buy bread from their factory.

There is a trade barrier in place preventing the factories from selling to the other country.

Each factory makes a profit of $2 on each loaf of bread.

The factory in Country 1 earns $4 from its sales. The people spend $40 on bread.

The factory in Country 2 also earns $4 from its sales of bread. It’s citizens only spend $20.

So, the net expenditure of money in Country 1 is $36, and in Country 2 $16.

Now, let’s see what happens if the trade barrier is removed.

Everybody now buys from the factory in Country 2.

So the factory in Country 1 earns nothing (it sells nothing) but its citizens spend only $20.

The factory in Country 2 earns $8 from its sales of bread to four citizens now. The citizens of country 2 spend the usual $20.

So, the net expenditure of money in Country 1 is now only $20 and in Country 2 only $12.

Economists argue that through this mechanism, the free market benefits all trading parties.

But it turns out that not everybody wins if you consider a different model – one that includes businesses shutting down and unemployment.

Model 2

When there are trade barriers, everyone works for the factories in their own countries.

With the barriers in place, the factory in Country 1 pays a salary of $20 to its two employees.

The factory in Country 2, being more efficient, pays a salary of $40 to its employees.

Now the net earnings in Country 1 (earnings – expenditure) are $4 (because the earnings cancel out the expenditure of the citizens, and the factory earns $4). The net earnings in Country 2 are now $64 (because the citizens spend only $10 each while earning $40, and the factory earns $4).

Now let’s say free trade is introduced.

The bread factory in Country 2 starts selling its bread at $10 in Country 1.

The bread factory in Country 1 shuts down (because no one will buy its bread at $20).

The citizens of Country 1 who worked for the bread factory no longer have an income. They still have to buy bread to survive (using their savings) but their expenditure is lower not at $20.

So now Country 1 ends up with a net earnings of $ -20 (a drop of $24).

The net earnings in Country 2 go up to $68 (and increase of $4).

So in this model, not only does the earnings of Country 1 go down but also the earnings of the world as a whole (because there are fewer people gainfully employed).

However, things don’t stop there.

Model 3

The bread factory realizes that by hiring the citizens of Country 1 to work for it instead of citizens of Country 2, it can cut its cost of production in half (because salaries in Country 1 are half that of Country 2). By doing so, it can start making profits of $6 per loaf of bread.

So now you have the citizens of Country 2 facing unemployment (no earnings).

So the net earnings of Country 2 drop to $4 (a drop of $64).

The earnings of Country 1 on the other hand go up to $20 (a gain of $40).

But there is again a drop in the earnings of the world, because though the same number of people are employed, it is higher-paid people who are now out of a job.

This is not compatible with a model of free trade that continually improves things for everybody.

Of course, I’ve used a very simple model, but it reflects the truth that when free trade is introduced, there are winners and losers and that the weaker parties are the losers.

There seems to be a way to predict who the winners and losers in any attempt to introduce free trade will be.

Force Model

In models of military engagements, the principle of force is used to predict the outcome. Given roughly equal equipment and training, the stronger force almost always wins.

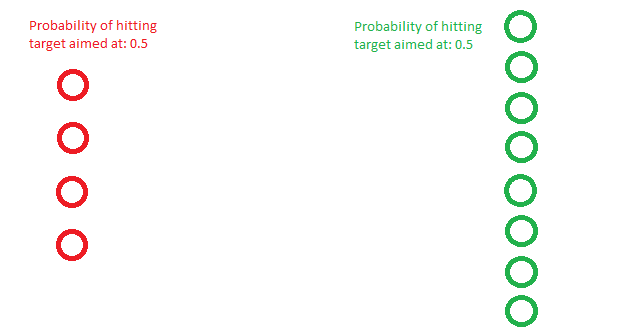

The reason for that is shown in the following diagram. Let’s say there is a red force with 4 soldiers and a green force with 8 soldiers. Each side fires a shot every minute. Each soldier aims at an enemy soldier and fires, with a 50% probability of hitting his target. After the first volley, the red force would have fired 4 shots and hit 2 green soldiers. But the green force would have fired 8 shots and hit 4 red soldiers.

So the losses would be disproportionately higher for the weaker party, and the green force would win the battle with the loss of two of their own.

It appears the same model can be used to predict the winners in economics too.

In economic models, the contending forces would be firms or employees.

Larger and better equipped firms (which can produce cheaper products) can be expected to win (push small firms or more expensive employees in direct competition out of business) in any market where free trade is introduced.

For example, before India traded freely with the USA, there were many local soft drink manufacturers (Torino, Thums Up and Limca) in India. When Coca Cola and Pepsi entered the market, all the Indian soft drink brands had to sell out.

Similarly cheaper workforces (which cost less to hire) can be expected to win.

An example would be the use of immigrant labour in many countries (especially the USA) for agriculture.

So, how can a weaker economic segment (be they workers or industry) be protected?

Through barriers (barriers allowed by trade agreements). Barriers (something that a force can shelter behind) may be used to protect weaker forces of any kind.

Here are a few barriers used in economics. As you can see, barriers to trade are already in heavy use though people talk as if free trade is widely practised.

Barrier 1

The US workforce in the computer industry being more expensive than an Indian workforce, has been protected by visa and fee barriers.

There are visa quotas and a fee levied on Indian firms – to the tune of $5000 per visa for H-1B and L-1 visas). The fee costs the Indian software industry $1 billion to $1.5 billion annually.

Not palatable to Indian industry of course, but effective in protecting high-end jobs in the USA.

Now what I don’t understand is why the USA uses barriers to protect jobs for skilled people who are highly qualified and quite capable of acquiring more skills and competing on quality.

I would suppose that if the USA used barriers, they should probably do so to protect jobs at the low end of the economy (helping out poorly skilled or unskilled workers who’d find it harder to acquire more skills or compete on quality) as India does (through a minimum salary requirement for work visas, which is aimed squarely at keeping out cheaper Chinese labour from infrastructure [say road building] projects).

Barrier 2

During the colonial era, barriers to the import of Indian products were used to protect a nascent textile industry and jobs in England.

I quote from an 1840 English parliamentary inquiry about India (taken from the above article):

Before a British Parliamentary Committee in 1840] Montgomery Martin stated that he . . . was convinced that an outrage had been committed ‘by reason of the outcry for free trade on the part of England without permitting India a free trade herself.’ After supplying statistical data of Indian textile exports to Great Britain, he pointed out that between 1815–1832 prohibitive duties ranging from 10 to 20, 30, 50, 100 and 1,000 per cent were levied on articles from India. … ‘Had this not been the case,’ wrote Horace Wilson in his 1826 History of British India, ‘the mills of Paisley and Manchester would have been stopped in their outset, and could scarcely have been again set in motion, even by the power of steam. They were created by the sacrifice of Indian manufacture. Had India been independent, she could have retaliated, would have imposed prohibitive duties on British goods and thus have preserved her own productive industry from annihilation. This act of self-defence was not permitted her’” (Clairmonte 1960: 86-87).

Barrier 3

Another example can be seen in the policy of subsidizing the renewable energy industry in the USA and buying renewable energy locally.

The use of models to determine winners, as described above, can empower governments to decide which sectors of the economy are most vulnerable to competition (so action may be taken to protect them).

Many protective actions can be taken without violating free trade obligations.

Fair Barrier 1

The best example of a fair protection policy is progressive liberalization.

For example, when the Chinese government introduced foreign direct investment (FDI) into the retail sector in China, it did so gradually, increasing the percentage of ownership permitted to foreign owners over 15 years.

In the course of the 15 years, local firms learnt the tricks of the retail trade and were able to compete effectively against the new entrants.

In contrast, the Indian government went from discouraging the participation of Indian private firms in the railways and defense industries, to allowing 100% FDI in one shot, thus failing to give Indian firms the time to develop the capabilities or technical know-how to compete in these markets, with the result that bullet train and metro rail equipment needs to be imported in entirety (or imported with a ‘made in India’ veneer – assembled in Indian factories entirely owned and operated by French firms).

Fair Barrier 2

Another policy that could protect and benefit businesses in certain sectors is grants for nascent industries with vast future potential. In the USA, there are small business grants, research grants and subsidies for small firms.

In contrast, the government of India seems to have failed to create a level playing field for local startups. I recall many years ago (at the height of the internet boom) when the government of India had a small business grants program, it had a clause specifically leaving out Indian software startups. Somehow the government of India had decided that they would not make research grants available to local startups in the highest-growth industry in India at the time.

Here’s more on how the Indian government seems to not be as accessible to local startups as it is to larger global startups/firms competing with them. This is a problem that needs to be fixed.

It’s easier for a foreign startup or MNC to get forgiveness for inadvertent violation than it is for a domestic startup (today foreign startups enjoy better access to political leaders and therefore easier forgiveness).

Uber got 1.5 years of forgiveness on payments that Ola did not get, and Amazon got forgiveness for having its own supply centres, and not following the marketplace model, which Flipkart did not get. Flipkart had to change its model to comply with the marketplace model. Both Ola and FK were hurt by this favoritism to Uber and Amazon.

Fair Barrier 3

Another method is to strengthen the weakest parts of the workforce in the face of competition from migrant/immigrant labour.

One policy that could help protect and improve the lot of weaker parts of the US workforce might be higher taxation, and using the tax money to:

- Sponsor education programs (financial-need-based free college/training) to facilitate reemployment in growing industry segments.

- Revive industries that could employ that part of the workforce in larger numbers (the manufacturing industry). One way to revive manufacturing that might be to create more outlets for US made goods and fund automation of manufacturing.

- Visa barriers (Indian work visas require a minimum salary that effectively protects less skilled workers).

Fair Barrier 4

Using regulatory and tax barriers to FDI (as is done in China) to generate scalable revenue for local businesses.

Conclusion

In conclusion, I wanted to point out that if governments could start using models such as the one above to calculate who might win in various scenarios involving free trade (instead of assuming that everyone wins), they might be able to formulate better and more equitable economic policies for their citizens.